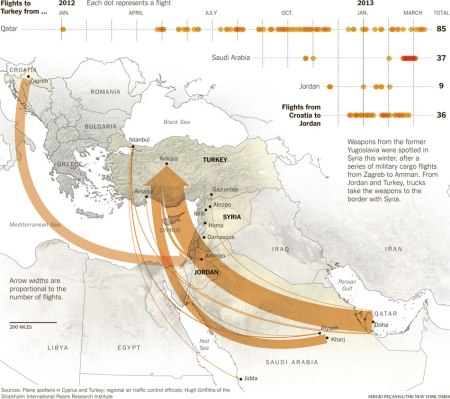

Sunday’s New York Times featured an article about the ‘secret airlift of arms and equipment for the uprising against President Bashar al-Assad’, overseen by CIA officers:

From offices at secret locations, American intelligence officers have helped the Arab governments shop for weapons, including a large procurement from Croatia, and have vetted rebel commanders and groups to determine who should receive the weapons as they arrive, according to American officials speaking on the condition of anonymity.

Washington’s imperial caravan of weapons dealing and covert funding of political interference in other states proceeds via the aid of financial globalization. Its wheels are greased by the international role of the dollar as global reserve currency and source of aggregate demand.

Suzerainty means being able to fund your proxy wars in a roundabout way: by directing the Qatari, UAE or Saudi Arabian holders of your government liabilities (private agents as well as the central banks and sovereign wealth funds of net creditor countries) to do so.

In this respect, the provision of arms, loans and military training to proxy forces is another branch of ‘aid’ or development assistance. It regularly involves the same multilateral organizations, NGOs and donor conferences, and is justified publicly using the same messianic ideologies of imperial benevolence and munificence.

It is US indebtedness, however, that allows it to act as banker, arms supplier and instructor to the world’s jihadis and regime changers. An outflow of dollars is needed both to furnish ‘less-developed’ countries with the liquidity needed to service their debt obligations, and to allow an ‘opposition’ to purchase weapons from NATO and its allies and pay the salaries of rebels.

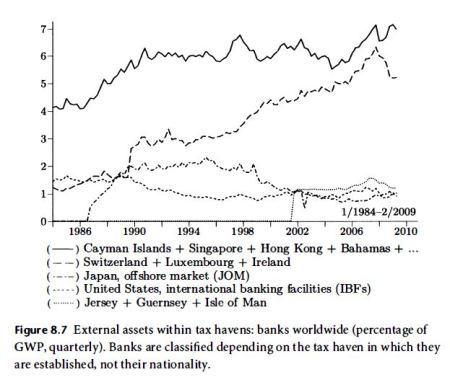

Since the 1960s the emission of dollars abroad through US external deficits has fuelled the growth of liquid international money markets (Eurodollar bank deposits) domiciled outside the US.

These offshore markets — with the City of London being the first and biggest — usefully supplement the domestic Fed-governed system’s supply of dollar-denominated credit with a private pool of dollar balances.

An immense volume of offshore transactions (the Eurodollar money market is the world’s most liquid) allows alternative funding routes to be designed when, for whatever reason (domestic regulations, international sanctions, arms embargoes, diplomatic amour-propre), official channels won’t do.

Offshore banking centres and tax havens flourish in jurisdictions that were created and now endure for the purpose of financial racketeering. These launder the blood-stained proceeds of arms trading, gold smuggling, drug trafficking, prostitution and gambling.

They include the City of London, Dublin, Switzerland, Luxembourg, Singapore, Hong Kong, the Cayman Islands, British Virgin Islands, the Channel Islands, Gibraltar, Antigua and Barbuda, Bermuda, the Bahamas, Sint Maarten, Panama, Cyprus, Malta, Vanuatu, the Cook Islands, Monaco, the UAE, Bahrain, Qatar, Oman and Kuwait.

The complexity and volume of transactions creates a lucrative niche for financial-services and other professionals (accountants, lawyers, ‘consultants’). Criminals and illicit firms also engage in ‘legitimate’ business ventures: real estate, construction and development, cash-intensive enterprises like tourism and hotels, and above all banking.

Dirty money can be converted into ‘clean’ capital gains by investing funds in highly liquid assets (e.g. gold or precious metals, fine art, bulk commodities like oil or wheat) which are anticipated to appreciate in price.

Thus transnational so-called ‘organized crime’ is not a distinct world. It is intertwined with, rather than divorced from, the ordinary economy, and overlaps with the political establishment, public officials and law-enforcement agencies.

It has intimate links with intelligence and diplomatic agencies: as shown by BCCI and Banco Ambrosiano; Iran-Contra; funding of the mujahideen in Afghanistan, Solidarnosc in Poland, and the KLA in Yugoslavia; Nugan Hand Bank in Australia; Khodorkovsky’s Menatep Bank and capital flight from Russia (abetted by Harvard advisors funded by the US State Department); and operations in Francophone central Africa and East Asia involving the French political elite, defence contractors (EADS and Thale), the oil company Total/Elf and the ‘Clearstream affair’.

‘Black market’ activities allow intelligence agencies to stretch their budget for covert operations, and to evade international sanctions and NATO-created embargoes (e.g. in the ex-Yugoslavia, Iraq, and now Iran and Syria). Civil wars, as Somalia demonstrates, provide ideal settings for profitable kidnapping, extortion and protection rackets.

Equally, accusations of participation in or association with organized crime can be made to strengthen the repressive power of law enforcement or intelligence agencies, pollute popular opinion, settle intra-elite scores, or move state policy in a desired direction by sidelining ‘tainted’ individuals or entities.

Nixon’s smashing of the ‘French connection’ had as its useful by-product the reduction of the Quai d’Orsay’s influence in Turkey and the Levant and the consolidation of the Maronite elite’s hold over the Lebanese state and local commerce (against the Muslim upstarts in the Intra Bank). British journalist Claire Sterling was the conduit for black propaganda associating Bulgarian intelligence with the assassination attempt on Karol Wojtyla.

And, since the late 1990s and especially after the World Trade Center and Pentagon attacks of September 2001, governments have enacted laws against ‘transnational organized crime’ and the financing of terrorism. Emergency circumstances, as they are officially described, have granted authorities the right to seize property and confiscate ‘proceeds of crime’ or terrorism.

In reality, it is the manoeuvres of imperialism itself (destabilization campaigns in preparation for armed interventions, regime change, IMF loan conditionality, financial liberalization and deflationary crises) that have criminalized the Balkan region and eastern Mediterranean. Together they have created a latitudinal band of turmoil, official corruption and mass pauperization that sweeps clear across central Asia.

These symptoms of entrenched crisis and misery in the peripheral zones of the world economy are the obverse of US external deficits. The reflux of dollars caused by global payments imbalances (from the surplus countries, to their US debtor, to ’emerging markets’) ensures that the disarray of the advanced capitalist countries is visited upon the hinterlands, since Washington itself faces no binding liquidity constraint.

Whole regions slide stealthily off the economic map as the promise of ‘development’ recedes.

Washington’s increasingly brazen militarism and belligerence over the past two decades is thus bound up with changes in the financial institutions, credit mechanism and monetary arrangements of world capitalism, which have also transformed the very nature of money.

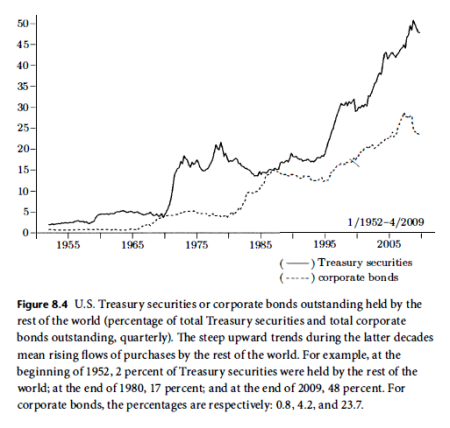

By 1945, and especially after 1971, the best-quality money — as measured by the willingness of other central banks, sovereign wealth funds and private holders of foreign exchange to accept and accumulate it, and by the preparedness of private buyers and sellers to establish commodity prices denominated in terms of it — was the dollar liabilities of the United States government.

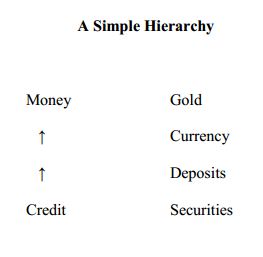

Institutions of money and credit are hierarchical: some promises to pay are more credible than others, and one specific form of money is acknowledged (generally by legal definition) as the best-quality measure of value and ultimate means of payment.

At the top of the monetary pyramid sit those agents whose liabilities (e.g. private promises to pay, commercial bills, state currency, Treasury bonds, central bank deposits) are most socially acceptable in transactions and are used as stores of value.

That the state issues the ultimate domestic money is natural because it has the best quality debt: a state with the power to impose tax obligations in its own currency faces virtually no liquidity constraint and is the most creditworthy borrower.

Its liabilities (i.e. currency or central-bank deposits) serve as the ultimate means of settlement for domestic payments.

But typically, most notably during the international gold standard formed after 1870, the ultimate international monetary unit has been the ‘outside money’ of gold, an asset of central banks that was no-one’s liability.

A government settling its external account with foreign counterparts needed gold. Alternatively (and increasingly during the late nineteenth century) it used some commonly accepted reserve currency or monetary standard such as the pound sterling (in which, thanks to the Empire and London’s role as world banker, governments typically held a portion of their external balances).

Changes to the monetary hierarchy and to the system of international settlements during the twentieth century (above all, shedding of convertibility of currencies to gold at a fixed rate) involved adjustments to the respective monetary space commanded by national currencies such as the pound sterling, the franc and the dollar, i.e. the domains of economic activity in which each of them circulated.

World capitalism’s discarding of a metallic standard to underpin its monetary system was an index of the strength of one imperial state.

This reflected the nature of the new global order, in which the US state (as well as claiming jurisdiction and tax authority over the world’s greatest concentration of productive resources) was able to suppress the foreign-policy independence and direct the regional and domestic affairs of other advanced capitalist state in a manner never before seen.

Imperial rivals, once subdued, could not pursue strategic objectives outside of US-dominated institutions — which is to say, scarcely at all.

Deranged ambitions for a Kautskyite ultra-imperialism, dominated permanently by US arms, continue to receive a public airing, as with G.W. Bush in his 2002 address to West Point graduates:

We have our best chance since the rise of the nation state in the 17th century to build a world where the great powers compete in peace instead of prepare for war.

The history of the last century in particular was dominated by a series of destructive national rivalries that left battlefields and graveyards across the earth. Germany fought France, the axis fought the allies, and then the East fought the West in proxy wars and tense standoffs against the backdrop of nuclear armageddon. Competition between great nations is inevitable, but armed conflict in our world is not.

More and more civilized nations find themselves on the same side, united by common dangers of terrorist violence and chaos. America has and intends to keep military strengths beyond challenge. Thereby making the destabilizing arm races of other eras pointless and limiting rivalries to trade and other pursuits of peace.

Today the great powers are also increasingly united by common values instead of divided by conflicting ideologies. The United States, Japan and our Pacific friends, and now all of Europe share a deep commitment to human freedom embodied in strong alliances such as NATO. And the tide of liberty is rising in many other nations.

But Washington’s policymaking elite is under no illusions: US pre-eminence can only be prolonged at the expense of other imperial powers. Thus the historical emergence of dependence, cooperation and servility among Washington’s junior partners (West European states, Tokyo) merits investigation, not least for what it can tell us for about the ultimate lifespan or historical limit to this state of affairs.

For what underpins the ability of states to borrow, to have their liabilities (cash, deposit accounts at the central bank, Treasury bonds, etc.) accepted?

National currency is a token that can be used to discharge tax obligations, while state debt securities promise to yield a revenue stream of interest financed out of taxation.

But, today, Washington’s strategic primacy rests ever more directly on its use of military power to pursue its goals and subdue its competitors, rather than on its ability to mobilize real resources through taxation. For the moment, US military activities and armaments spending, undertaken without heed to any binding liquidity constraint, provide their own best guarantee.

Facing stark choices brought about by global imbalances, the US ruling elite has adopted political methods of last resort: permanent war financed by a colossal pyramid of dollar liabilities.

The volume of funds flowing into Eurodollar money markets swelled dramatically after 1973. At the insistence of Washington, a large share of oil-export receipts held by the central banks of OPEC countries were invested in US Treasury securities purchased outside the regular auctions.

In return for disbursing oil rents in the desired fashion, the obliging governments of Saudi Arabia, Kuwait and Iran received US military hardware, security training and guarantees of protection.

Some of the petrodollar inflow was recycled outward as loans to ‘developing markets’ (Argentina, Brazil, Mexico, Greece, Turkey, South Korea, Yugoslavia and the Philippines). The injection of credit to these economies sparked speculative bubbles in commodity prices or local real estate, rendering domestic producers less competitive and hollowing out industry before terminating in debt crises, inflation and currency depreciation – as in the Mexican crises of 1982 and 1994, the East Asian crisis of 1997-98 and the ruble collapse of the same year.

Today, these same dutiful energy-exporting Arabian peninsula members of the Gulf Cooperation Council (together with Turkey) are the proximate source of weapons wielded against the Syrian government on behalf of Washington.

Two days ago the Wall Street Journal published information from US officials that the CIA was ‘expanding its role in the campaign against the Syrian regime by feeding intelligence to select rebel fighters to use against government forces’:

The expanded CIA role bolsters an effort by Western intelligence agencies to support the Syrian opposition with training in areas including weapons use, urban combat and countering spying by the regime… The provision of actionable intelligence to small rebel units which have been vetted by the CIA represents an increase in U.S. involvement in the two-year-old conflict, the officials said…

Syrian opposition commanders said the CIA has been working with British, French and Jordanian intelligence services to train rebels on the use of various kinds of weapons. A senior Western official said the intelligence agencies are providing the rebels with urban combat training as well as teaching them how to properly use antitank weapons against Syrian bunkers.

The agencies are also teaching counterintelligence tactics to help prevent pro-Assad agents from infiltrating the opposition, the official said.

Among other U.S. activities on the margins of the conflict, the Pentagon is helping train Jordanian forces to counter the threat posed by Syria’s chemical weapons

Despite long-standing evidence of Washington and its allies’ efforts to ‘shape the outcome in Syria’, Australia’s Socialist Alternative has led cheers for the proxy forces of what it insists on calling the ‘Syrian revolution’:

Imperialism, in the sense of Western neo-colonialism, is not the main threat facing the masses of Syria, or of the Arab world as a whole.

This can seem a sacrilegious statement to anyone who got their political education on the left in the post-9/11 world. After the 9/11 attack, when the US went to war on Afghanistan, there were a tiny number of political voices who stood against the tide and protested against the war. We were denounced as “knee-jerk anti-imperialists”.

In those turbulent days we wore the “knee-jerk” accusation as a badge of pride. If the US military did it, we were against it. And we were right. In those years, anti-imperialism was a crucial starting point because US imperialism was the decisive element in world politics. The time for “knee-jerk anti-imperialism” has now passed. Not because US imperialism has disappeared from the Middle East, or shed its malevolent intent, but because the world has changed.

The Arab revolution has transformed everything. We now live not in a “post-9/11 world” but in a “post-Tahrir world”.

The characteristically puerile tone ought not to distract from the deplorable message itself. Intellectual infirmity is one thing, and political efficacy quite another. Many well-meaning but politically naive people will doubtless have thrown their support behind NATO-led regime change in Syria due to these ‘left’ arguments, which complement the liberal-humanitarian ones propounded by the mainstream media outlets. Thus an avowedly socialist organization partakes in a US and Israeli strategic move to advance their regional position.

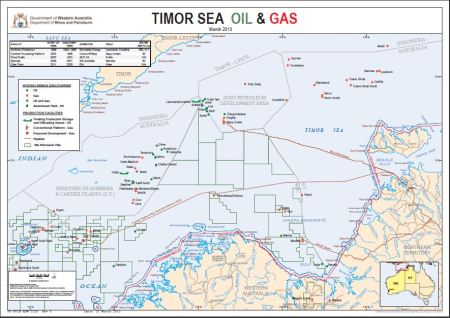

US foreign policy is now hostage to the pursuit of oil in a way that resembles fascist Germany during the 1930s. The keystone of Washington’s global power is military control over West Asian oil, secured by US advantages in weapons systems and logistics that grant it control of sealanes, skies and communication networks while allowing it to establish land-based Eurasian protectorates.

Over the past decade the nexus of energy industry and imperial state has grown denser both in Washington and among its allies.

Thus yesterday a press release by the Australian Mines and Metals Association welcomed Julia Gillard’s appointment of Gary Gray as federal resources and energy minister. Gray, it said, was ‘highly regarded by the resources sector.’

Gray was national secretary of the ALP during the 1990s, and later became director of corporate affairs at Woodside Petroleum.

Between jobs, in 2001 he served as a lobbyist for Woodside when ‘Australia’s biggest oil and gas company’ sought to repel a bid by Royal Dutch Shell to acquire a controlling interest in the company.

In what was described as a ‘lobbyist’s heaven’, Gray reportedly earned a seven-figure bonus after Treasurer Peter Costello and the Foreign Investment Review Board refused the takeover on ‘national interest’ grounds.

Ashton Calvert, chief of the Department of Foreign Affairs and Trade from 1998 to 2005 (during which time Canberra undertook two military interventions in East Timor) later became a director of Woodside and Rio Tinto.

In 2004 senior DFAT official Brendan Augustin, now general manager of Woodside in East Timor, was granted two years leave from the government department to work for Woodside in Mauritania. After the Mauritanian government was overthrown by a military junta in 2005, Augustin negotiated a new production-sharing agreement for the Chinguetti offshore field.

Gray later claimed responsibility for Woodside’s request for a DFAT official:

We needed someone with French-Arabic cultural skills and we thought the arrangement would also benefit DFAT because at the end of it they would get back a person with knowledge and experience of the oil sector in western Africa. Brendan was an excellent candidate. He had experience in Dili. His wife, I think is a GP from East Timor. He knew the circumstances of living in the Third World.

Just like Socialist Alternative (and its international counterparts) today, in 1999 so-called left-wing organizations like Socialist Alliance and the now-defunct DSP provided a ‘progressive’ veil for Australian military intervention in East Timor. As with contemporary support for regime change in Libya and Syria, this is not to be explained by intellectual limitations or momentary confusion of the groups in question.

As imperialism grows more rapacious and belligerent, turning desperately to delinquent methods, dirty money and dubious individuals — as a seamless web of elite criminality forms to seize the world’s resources by the throat — at just this moment its ‘human rights’ chorus grows more supplicant and beguiling, its demands grow more insistent, and it seduces one after another ‘radical’ or progressive group.